For that reason, the method is best for small businesses that do not stock inventory. The Tax Cuts and Jobs Act increased the number of small business taxpayers entitled to use the cash basis accounting method. For 2024, small business taxpayers with average annual gross receipts of $30 million or less in the prior three-year period can use it. Companies with revenues of less than $25 million over 3 years and who aren’t corporations or partnership corporations have the option to use cash basis accounting. They may choose to use the cash basis method because it’s more straightforward, making it a good fit for business owners who don’t want to bring in additional accounting support.

If you are unsure which approach is best for your business, it may be a good idea to seek professional advice to determine if your company should use cash or accrual accounting. Under cash accounting, any income you receive during the tax year is included in your taxable income. This means you can claim those deductions in the year that you pay for them, even if you purchase them outside that tax year. Under accrual accounting, you include income in your annual taxable income if all the events’ tests are met for a given event. This means the transaction is fixed and you can reasonably predict the amount you will be paid. replacement value You can claim an expense as a deduction if economic performance has occurred, meaning that the property or service that you have paid has actually been provided.

- Keep in mind, however, that you must decide which method you want to use and then be consistent when tracking your income and expenses.

- Please read our review for more information on QuickBooks Online and our ratings for other top accounting software.

- Cash accounting is simple for a small business, as it’s just like taking care of your checkbook.

- The key advantage of the cash method is its simplicity—it only accounts for cash paid or received.

Cash vs. accrual accounting

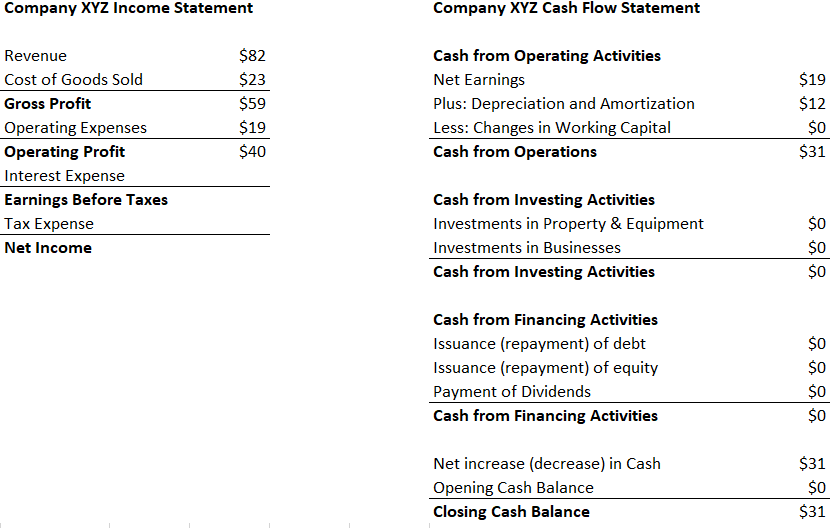

The cash method is best for small service businesses with low inventory, while the accrual what is comprehensive income its income not yet realized method of accounting is best for large businesses with complex practices. Under cash basis accounting, revenue is reported on the income statement only when cash is received. The cash method is typically used by small businesses and for personal finances. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future. Likewise, expenses for goods and services are recorded before any cash is paid out for them. The larger and more complex your business becomes, the more willing you should be to shift to accrual-basis-friendly software and services.

Learn the pros and cons of each bookkeeping method below and decide which one is right for you. Because of the differences between cash and accrual accounting, one method may be more appropriate for your business than the other. Luckily, most accounting software makes it easy to track your business’s finances with both cash basis and accrual methods. Keep in mind, however, that you must decide which method you want to use and then be consistent when tracking your income and expenses.

Cash Basis Accounting Method

In Quickbooks, you can choose either Cash or Accrual as your accounting method. You can also run reports that use either method, so you can compare how your finances look with each. Under the accrual method, the $5,000 is recorded as revenue as of the day the sale was made, though you may receive the money a few days, weeks, or even months later. Another disadvantage of the accrual method is that it can be more complicated to use since it’s necessary to account for items like unearned revenue and prepaid expenses.

What is accrual basis accounting?

And for businesses that focus on inward cash flow, it is easier to align earnings with important dates, making it easier to pay taxes on time. If you manage inventory, trade publicly on the stock exchange, own a C corporation, or have a gross annual revenue of $5 million or more, the IRS requires you to use accrual accounting. Additionally, if your customers can pay you for products on credit, ultimate profit tracker for your business you should be using the accrual accounting method. Otherwise, you and your investors won’t have an accurate understanding of your finances. The cash method of accounting seems pretty logical until you consider that many business owners do all the work for a project months before getting paid.

What’s the Difference Between Cash Basis and Accrual Basis?

Here’s how to calculate gross, operating, and net profit margins and what they can tell you about your business. As a result, an investor might conclude that the company is making a profit when, in reality, the company might be facing financial difficulties. For nearly a decade, Toni Matthews-El has published business topics ranging from cloud communication software to best steps for establishing your own LLC. In addition to Forbes Advisor, she’s published articles for Medical News Today, US News and World Report.

In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions.

It’s also vital to monitor your accounting or work with your accountant to ensure your business stays compliant when filing taxes. Using the above example, using the cash basis you would record the income in March, when the client pays your law firm, not in January when the invoice is sent. Most agricultural businesses use cash accounting to balance out volatility in the agricultural markets and manage operations consistent with cash flow. If farmers have to switch to accrual accounting, it would penalize them in an industry with high price volatility, rising production costs, and thin margins. Because this method gives you a more complete picture of your business’s finances, it’s more commonly used than the cash method.